Where ERP meets PMS: Lease accounting is now a data management problem

Discover how LOIS integrates with your ERP to streamline lease accounting, improve compliance, and eliminate data silos across teams.

Benchmark, analyse, and optimise your lease portfolio with a unified data source

Businesses have vast amounts of data, stored across multiple locations. This means that critical insights that can improve lease portfolio performance are unable to be analysed. This lack of control leads to risk.

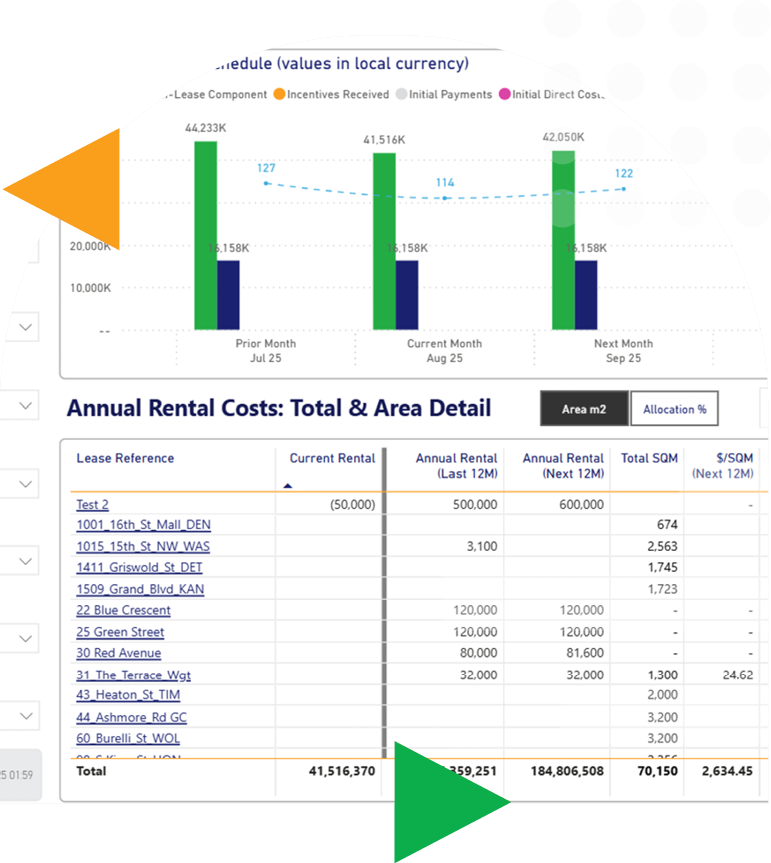

Our Lease Portfolio Analytics feature collates all your LOIS data with all other relevant leasing data in one central location. This allows you to analyse and control your entire portfolio through easily digestible and interactive dashboards, customised to the information you and all your stakeholders need to know.

Asset data is filtered by category to ensure consistent presentation, enabling better comparisons, benchmarking, and more accurate pricing decisions.

Generate automated reports for different functions from a single, centralised database. Reports are updated and delivered to stakeholders each month, reducing manual, ad-hoc reporting.

Accurately benchmark your Incremental Borrowing Rate (IBR) to understand its true commercial impact on your balance sheet and gain a competitive advantage.

Get a high-level overview of your lease portfolio costs and activities to see where you can drive more effective ways of leasing. Compare asset class and SQM costs, across different lease providers and locations.

Discover how LOIS integrates with your ERP to streamline lease accounting, improve compliance, and eliminate data silos across teams.

Discover how LOIS help organisations simplify lease management, automate IFRS 16 compliance, and gain real-time visibility across complex portfolios.

IFRS 16 compliance is now business‑critical. Discover why manual lease accounting no longer works and how LOIS makes compliance simple and...