Lease accounting

made simple

Ditch complexity, automate compliance, consolidate all leases, and give finance teams clarity and control (across IFRS 16, AASB 16, FRS 102 and FASB ASC 842) .

Why LOIS for lease accounting

Lease accounting (under IFRS 16, AASB 16, FRS 102 or FASB ASC 842) is complex. Outdated processes create risk, and month-end reporting drains time and resources.

With LOIS, lease accounting becomes faster, easier, and fully compliant. Let your team focus on strategy, not lease accounting compliance.

Simple &

intuitive

A user-friendly interface with clear visibility at every level of your lease portfolio.

Comprehensive compliance

Forecasting, modifications and automated journals for numerous accounting standards.

Centralised management

Manage property, fleet, and IT leases in one place for a single source of truth.

Fast & flexible integration

Easy import/export, Excel templates, and integrations with your existing systems.

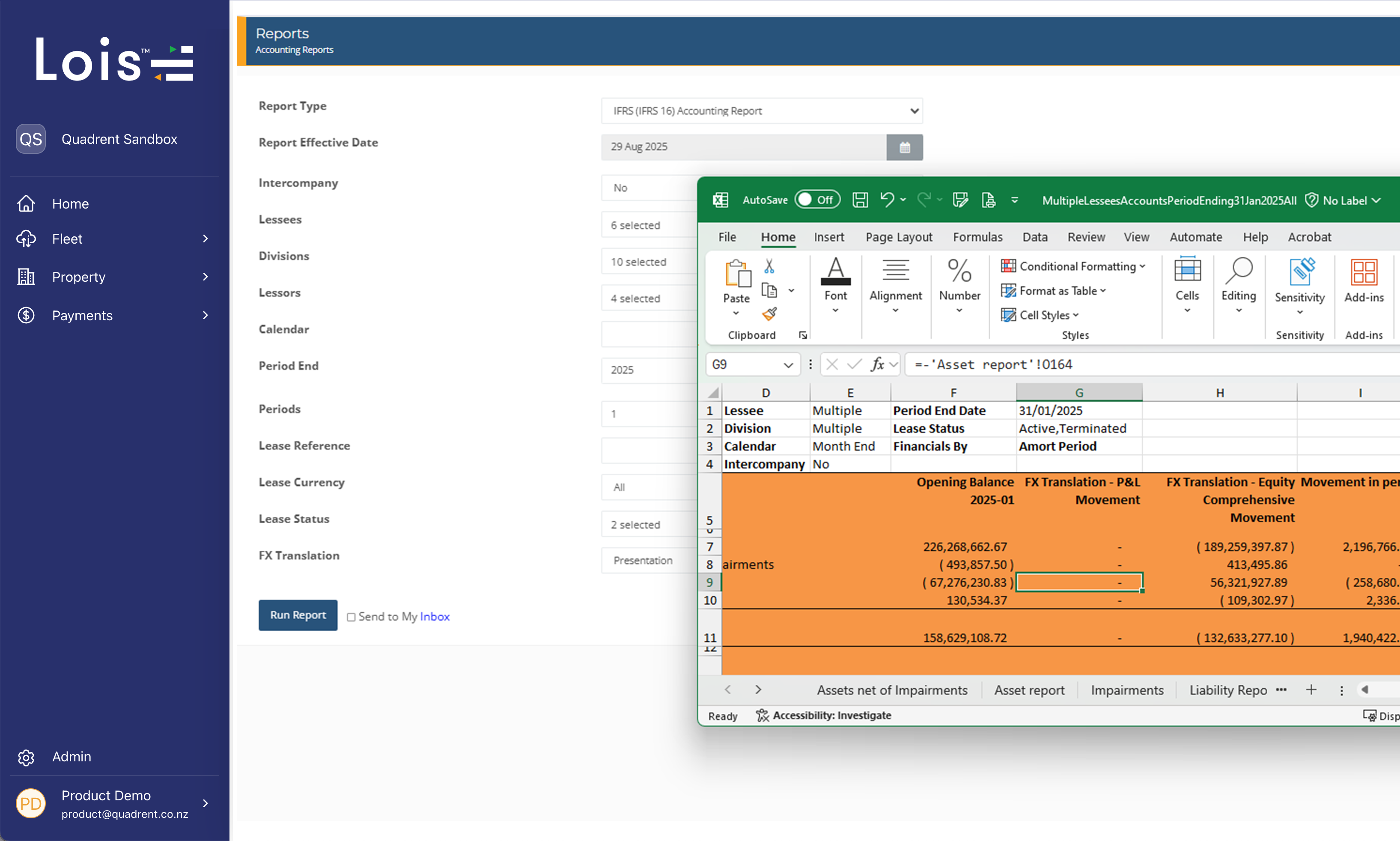

Global standards compliance

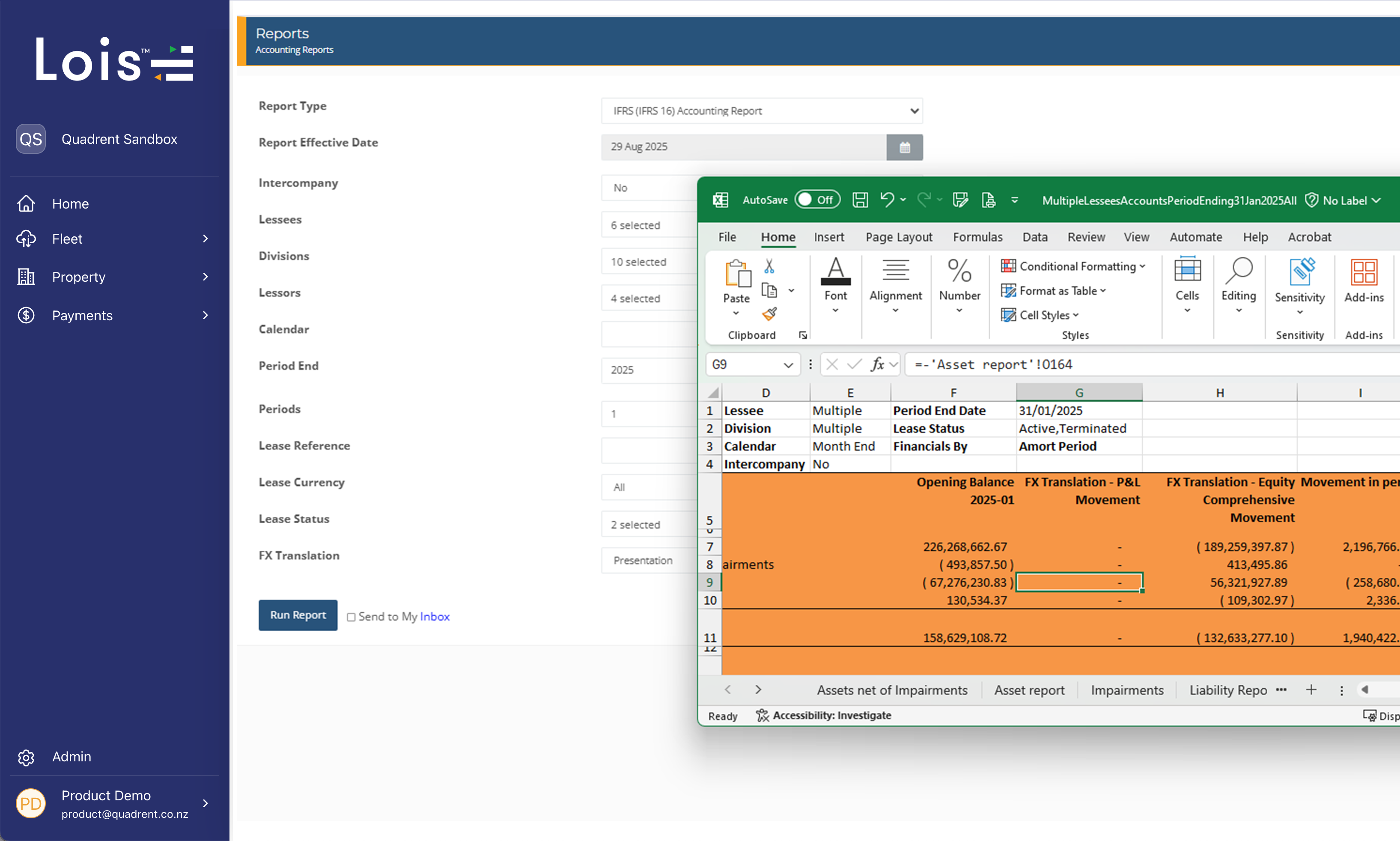

Instantly see how your critical performance metrics change under each standard. Run multiple lease accounting reports for numerous accounting standards (IAS 17, IFRS 16, AASB 16, FRS 102 and FASB ASC 842).

LOIS can handle all disclosures, under all standards, with a dedicated reporting module and fully automated general ledger for all accounting journals and modifications.

- Relevant accounting reports showing asset, liability, future rentals and disclosure summaries

- All relevant journals automated

- Vs. IAS 17, showing the difference in reporting outputs based on the reporting rates of the leases held in the system

Reporting & forecasting

LOIS’s full suite of standard reports provides you with all the tools required to help ensure a successful compliance to either IFRS 16, AASB 16, FRS 102 or FASB ASC 842. Track your progress in real time.

- Forecasting reports

- Movements between defined date parameters

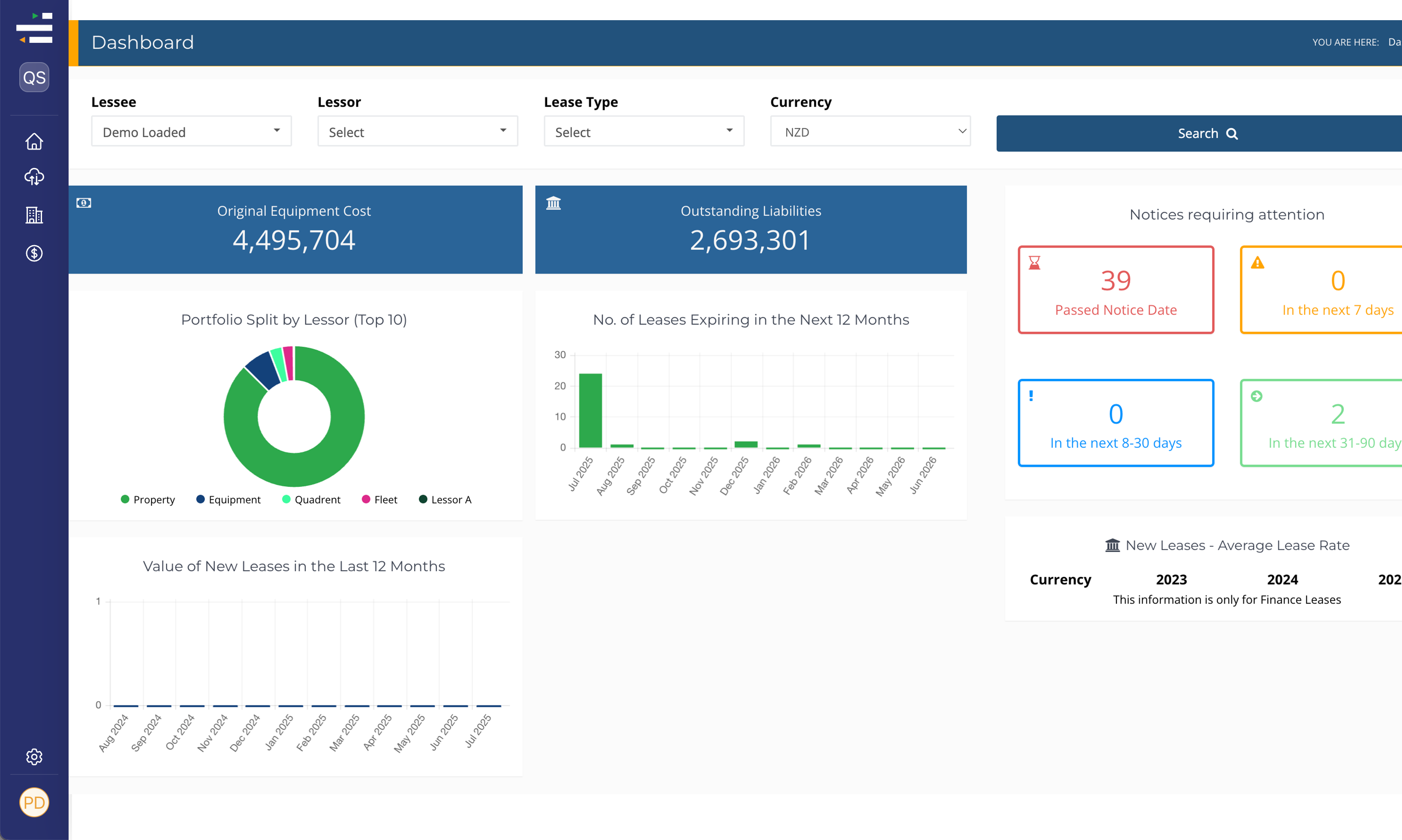

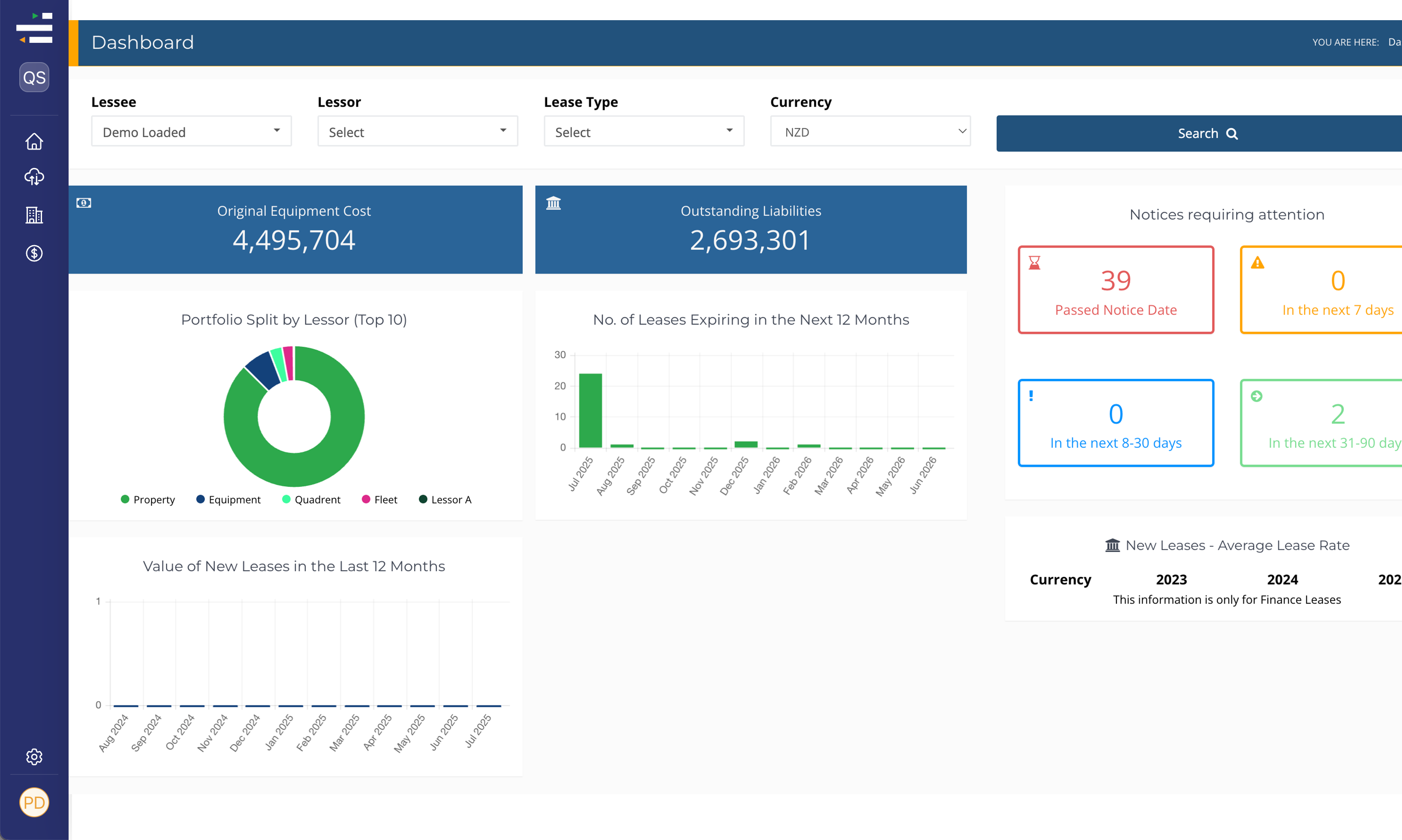

Consolidated dashboard

With all your leases and data in one place, the LOIS user dashboard provides you with a consolidated overview of all the active leases within your organisation. Use this information to:

- See how active leases are distributed globally

- Recognise leases that require immediate attention

- View and analyse data dependent on the selected search criteria set by the user

- Key financial metrics and ledger overview

- Drill down functionality

Instantly see how your critical performance metrics change under each standard. Run multiple lease accounting reports for numerous accounting standards (IAS 17, IFRS 16, AASB 16, FRS 102 and FASB ASC 842).

LOIS can handle all disclosures, under all standards, with a dedicated reporting module and fully automated general ledger for all accounting journals and modifications.

- Relevant accounting reports showing asset, liability, future rentals and disclosure summaries

- All relevant journals automated

- Vs. IAS 17, showing the difference in reporting outputs based on the reporting rates of the leases held in the system

LOIS’s full suite of standard reports provides you with all the tools required to help ensure a successful compliance to either IFRS 16, AASB 16, FRS 102 or FASB ASC 842. Track your progress in real time.

- Forecasting reports

- Movements between defined date parameters

With all your leases and data in one place, the LOIS user dashboard provides you with a consolidated overview of all the active leases within your organisation. Use this information to:

- See how active leases are distributed globally

- Recognise leases that require immediate attention

- View and analyse data dependent on the selected search criteria set by the user

- Key financial metrics and ledger overview

- Drill down functionality

Lease data & lifecycle management

-

Easy data upload

-

Custom data fields

-

Manage lifecycle & modifications

-

Amortisation & depreciation schedules

-

Journals & GL integration

LOIS’s intuitive design makes it easy to upload your lease data either manually, through a customised Excel template, or through an ERP integration, ensuring all your critical lease information is centralised in one place.

- Regular and irregular profiles (multiple rentals with different periodicities)

- Multi-asset addition

- Unlimited document storage for all aspects of leases

- Ability to save mid input as draft lease or confirm to activate a lease

LOIS records as much detail as you need for your leased asset data. Use custom fields to save information such as millage limits for vehicles, square metres for buildings, serial numbers for IT equipment or usage hours for forklifts.

All in-life lease amendments are catered for, adhering to the IFRS 16, AASB 16, FRS 102 and FASB ASC 842 standards covering all modifications. Make business as usual an easy process with all forms of modifications automated within the system. LOIS covers all modifications:

- Full extensions

- Part terminations

- Full early terminations

- Consideration changes

- Indexation price changes (IFRS)

- Rental corrections and impairments

At the commencement of a lease, LOIS generates an asset and amortisation schedule based on the financial information inputted into the system. With each modification to the lease, a new amortisation and asset schedule is created and stored to allow retrospective reporting based on the schedules in play at that time. These schedules drive the accounting output.

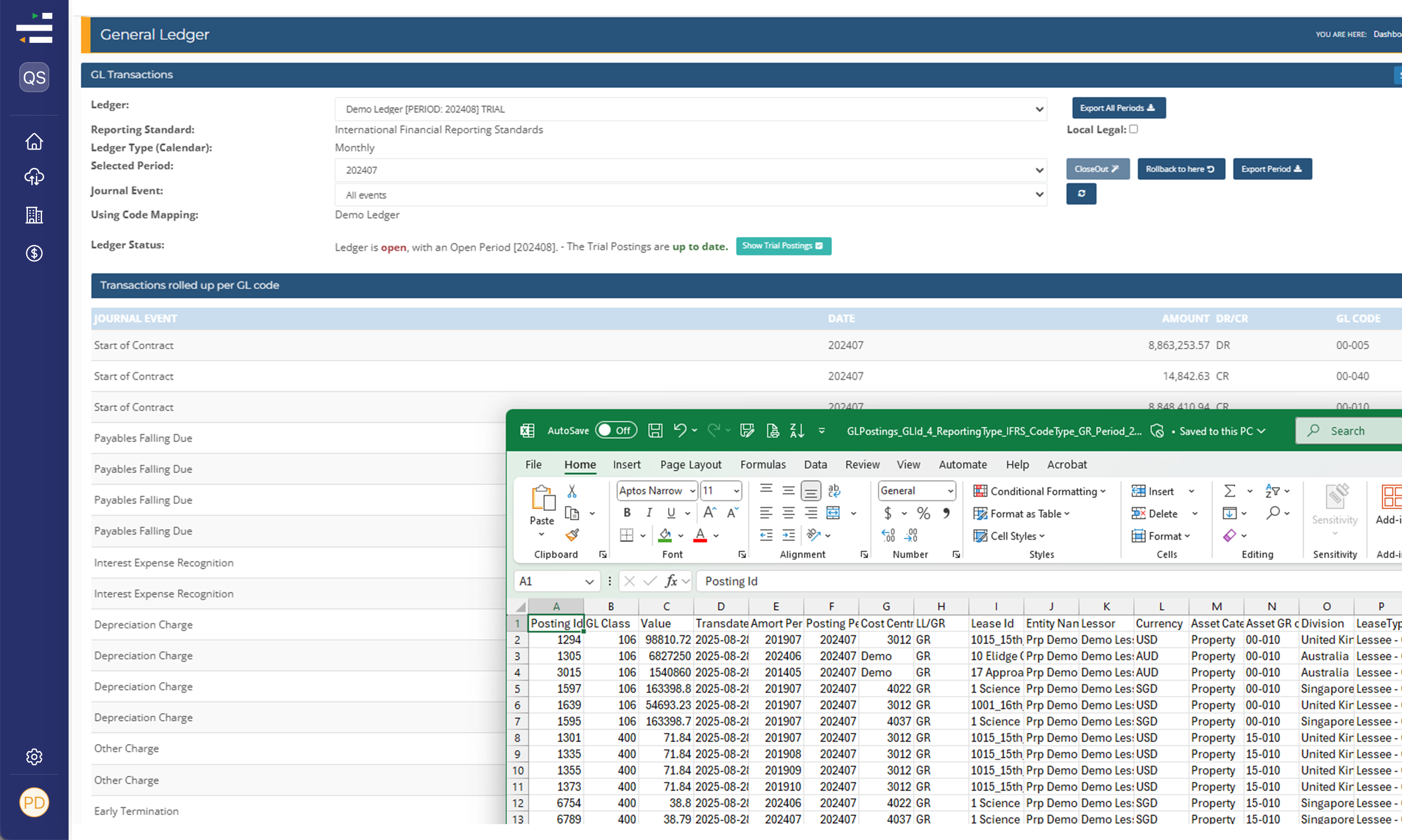

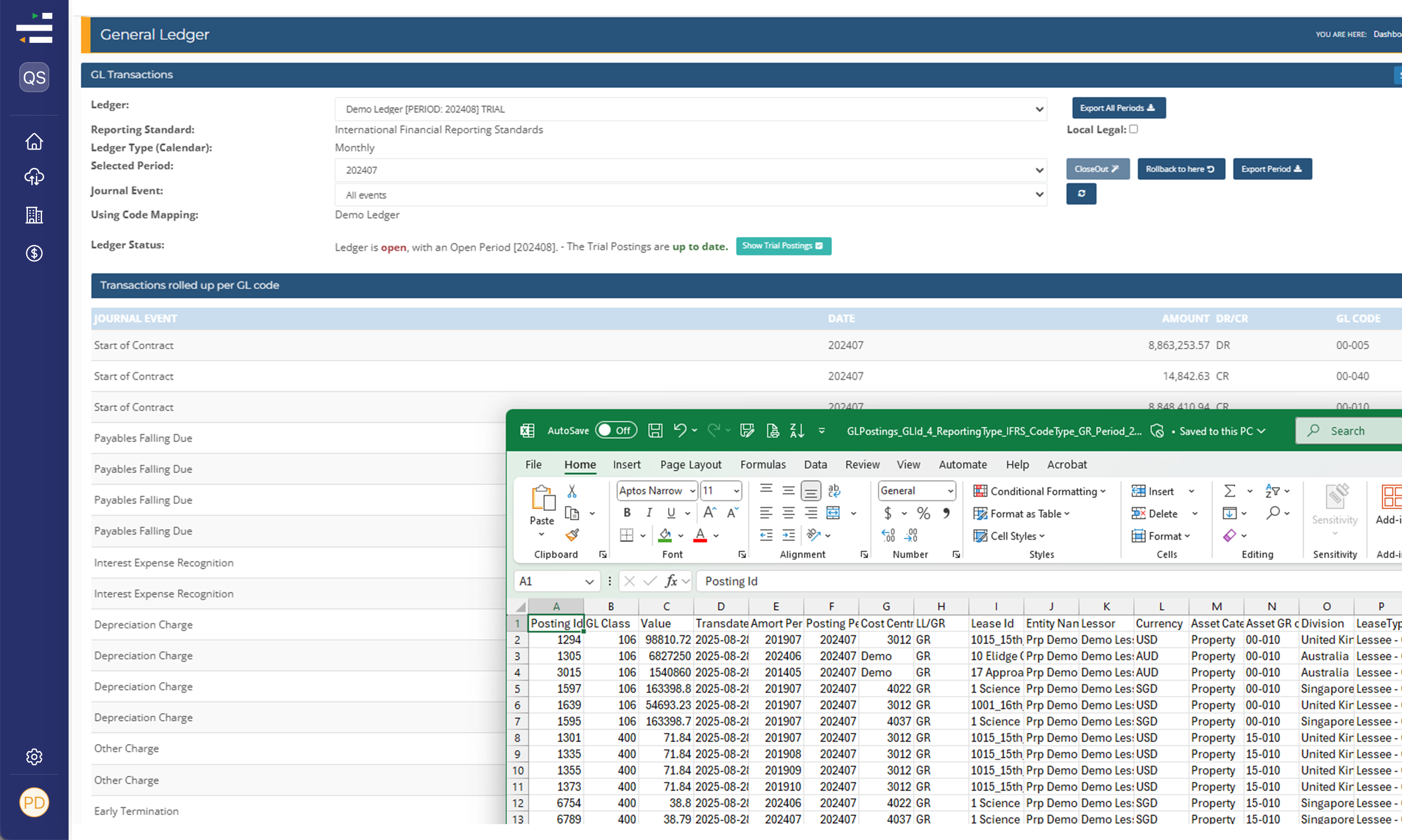

LOIS will also generate the complex calculations whilst providing full general ledger functionality and a comprehensive audit trail.

Journals are created in the system for IFRS 16, AASB 16, FRS 102 and FASB ASC 842 accounting entries. LOIS also has its own generic general ledger codes associated with each event in a lease’s life. These codes can be mapped to the user’s general ledger codes. Journals can be exported to Excel for upload to the general ledger or use our bespoke API to remit the journals to the user’s general ledger in an automated fashion.

Lease Data & Lifecycle Management

Easy Data Upload

Easy Data Upload

Upload your lease data with ease to ensure all your critical lease information is centralised in one place.

LOIS’s intuitive design makes it easy to enter all types of leases either manually, through a customised Excel template or with full integration into other in-house systems via a bespoke integration tool.

- Regular and irregular profiles (multiple rentals with different periodicities)

- Multi-asset addition

- Unlimited document storage for all aspects of leases

- Ability to save mid input as draft lease or confirm to activate a lease

Custom data fields

Custom data fields

LOIS records as much detail as you need for your leased asset data. Use custom fields to save information such as millage limits for vehicles, square metres for buildings, serial numbers for IT equipment or usage hours for forklifts.

Manage Lifecycle & Modifications

Manage Lifecycle & Modifications

All in-life lease amendments are catered for, adhering to the IFRS 16 and FASB ASC 842 standards covering all modifications. Make business as usual an easy process with all forms of modifications automated within the system. LOIS covers all modifications:

- Full extensions

- Part terminations

- Full early terminations

- Consideration changes

- Indexation price changes (IFRS)

- Rental corrections and impairments

Amortisation and depreciation schedules

Amortisation and depreciation schedules

At the commencement of a lease, LOIS generates an asset and amortisation schedule based on the financial information inputted into the system. With each modification to the lease, a new amortisation and asset schedule is created and stored to allow retrospective reporting based on the schedules in play at that time. These schedules drive the accounting output.

Journals & GL Integration

Journals & GL Integration

LOIS will also generate the complex calculations whilst providing full general ledger functionality and a comprehensive audit trail.

Journals are created in the system for both IFRS 16 and FASB ASC 842 accounting entries. LOIS also has its own generic general ledger codes associated with each event in a lease’s life. These codes can be mapped to the user’s general ledger codes. Journals can be exported to Excel for upload to the general ledger or use our bespoke API to remit the journals to the user’s general ledger in an automated fashion.

Easy Data Upload

Upload your lease data with ease to ensure all your critical lease information is centralised in one place.

LOIS’s intuitive design makes it easy to enter all types of leases either manually, through a customised Excel template or with full integration into other in-house systems via a bespoke integration tool.

- Regular and irregular profiles (multiple rentals with different periodicities)

- Multi-asset addition

- Unlimited document storage for all aspects of leases

- Ability to save mid input as draft lease or confirm to activate a lease

Custom data fields

LOIS records as much detail as you need for your leased asset data. Use custom fields to save information such as millage limits for vehicles, square metres for buildings, serial numbers for IT equipment or usage hours for forklifts.

Manage Lifecycle & Modifications

All in-life lease amendments are catered for, adhering to the IFRS 16 and FASB ASC 842 standards covering all modifications. Make business as usual an easy process with all forms of modifications automated within the system. LOIS covers all modifications:

- Full extensions

- Part terminations

- Full early terminations

- Consideration changes

- Indexation price changes (IFRS)

- Rental corrections and impairments

Amortisation and depreciation schedules

At the commencement of a lease, LOIS generates an asset and amortisation schedule based on the financial information inputted into the system. With each modification to the lease, a new amortisation and asset schedule is created and stored to allow retrospective reporting based on the schedules in play at that time. These schedules drive the accounting output.

Journals & GL Integration

LOIS will also generate the complex calculations whilst providing full general ledger functionality and a comprehensive audit trail.

Journals are created in the system for both IFRS 16 and FASB ASC 842 accounting entries. LOIS also has its own generic general ledger codes associated with each event in a lease’s life. These codes can be mapped to the user’s general ledger codes. Journals can be exported to Excel for upload to the general ledger or use our bespoke API to remit the journals to the user’s general ledger in an automated fashion.

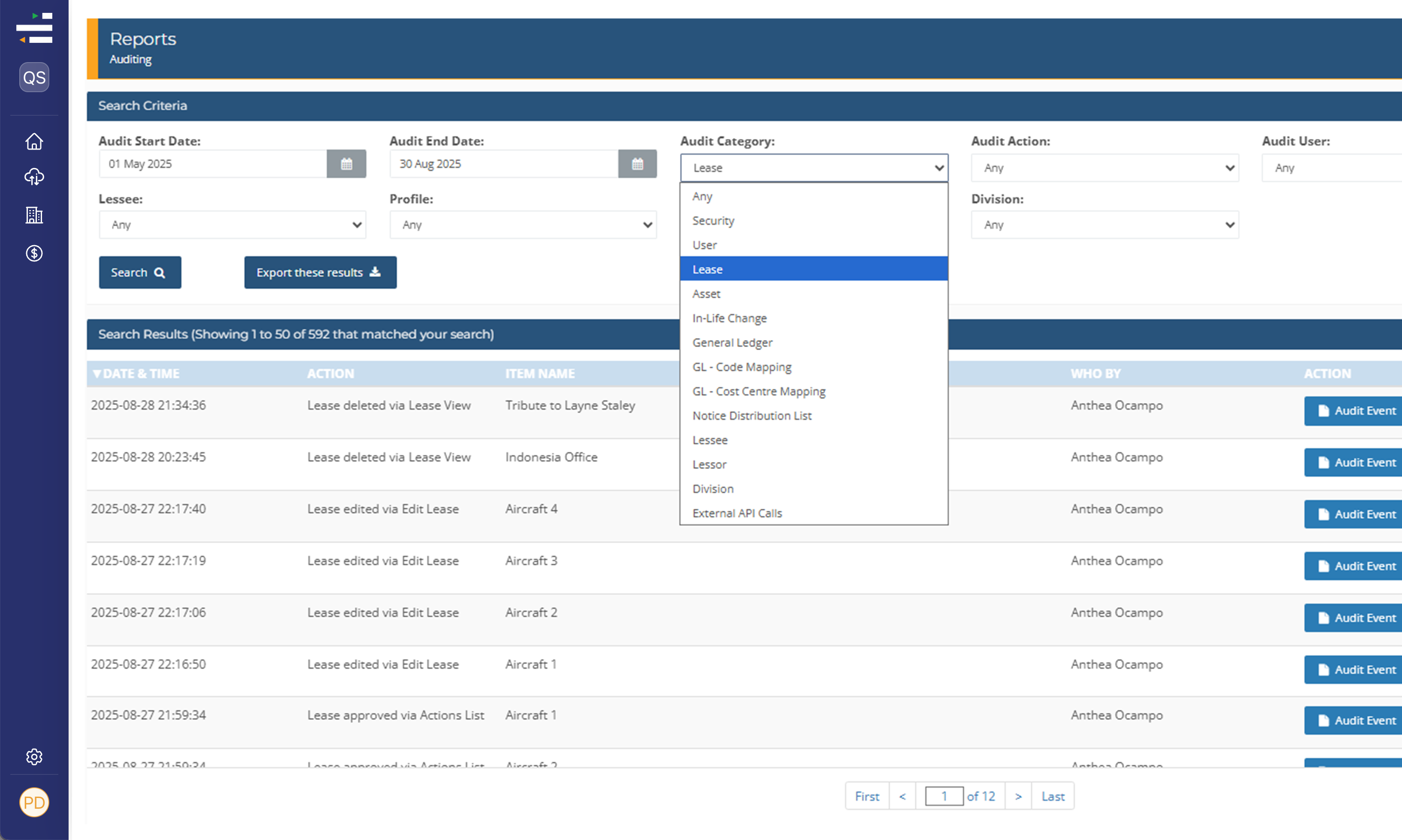

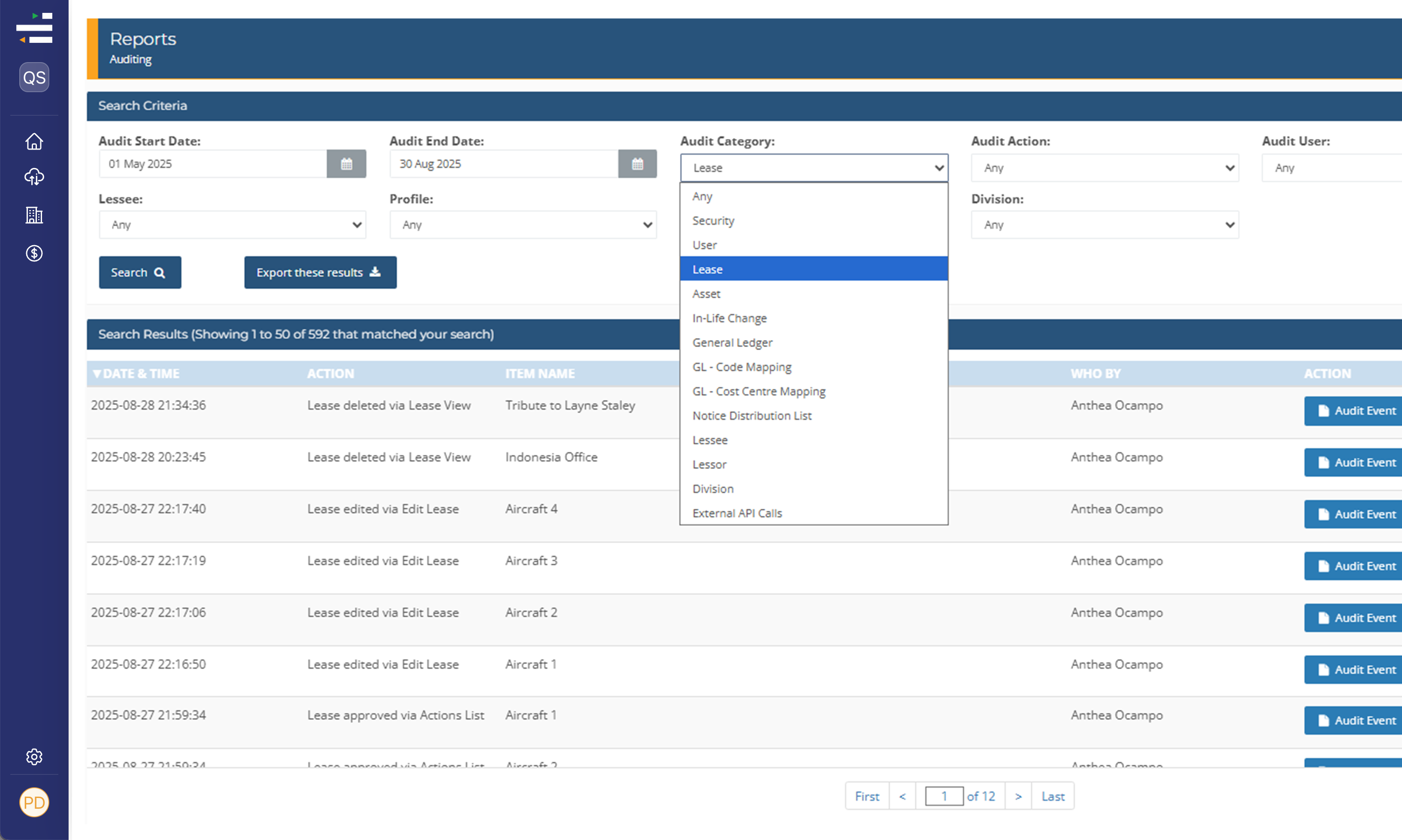

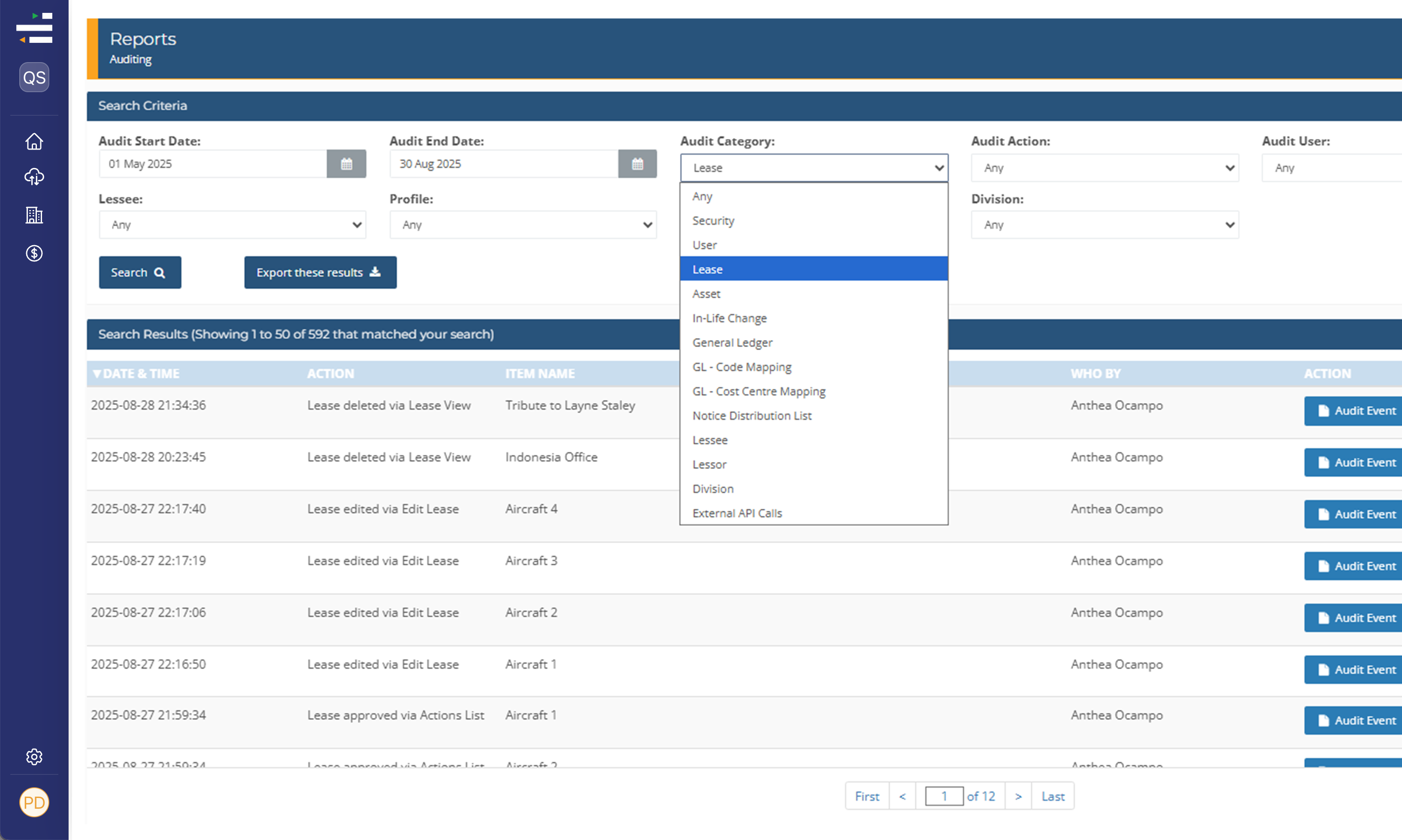

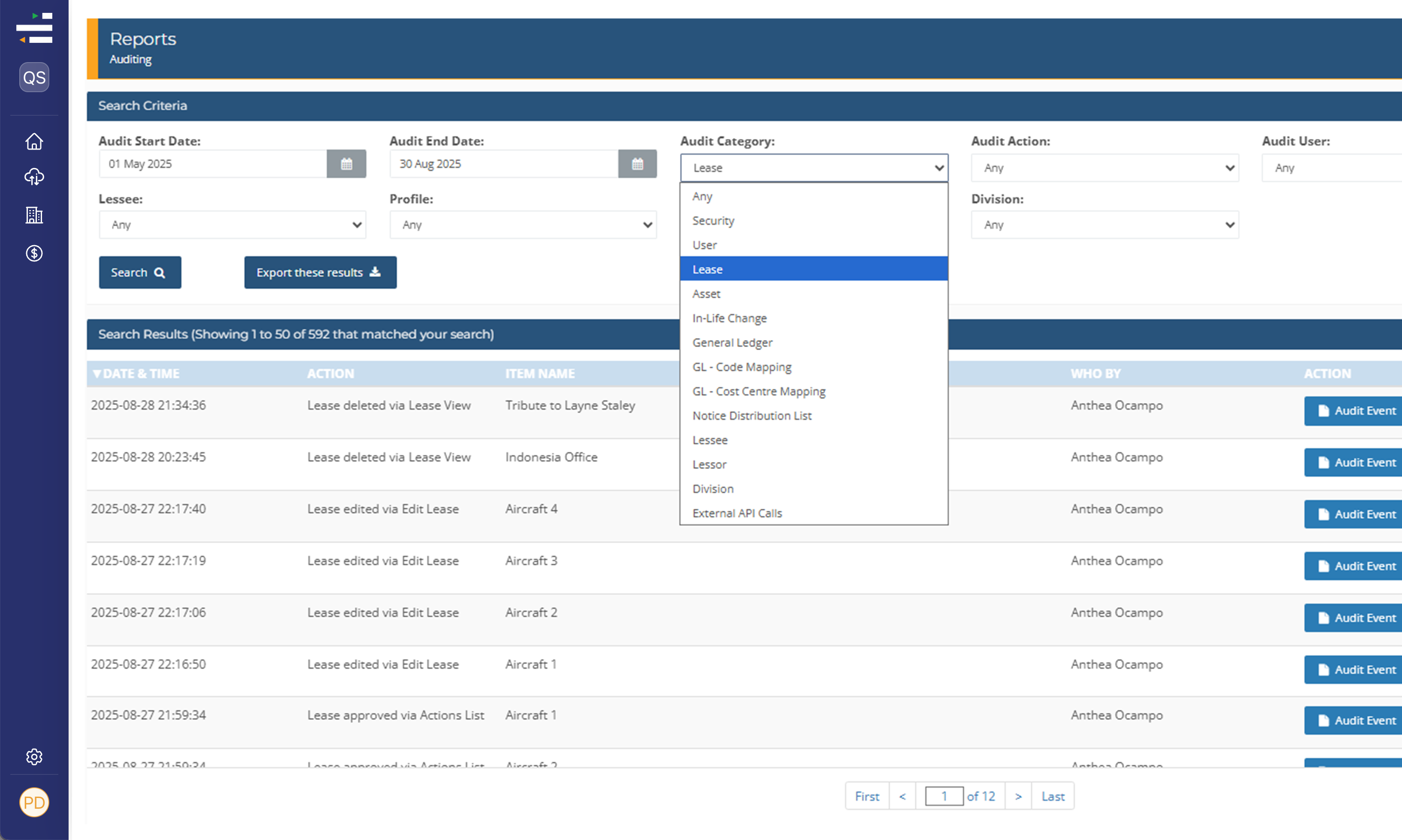

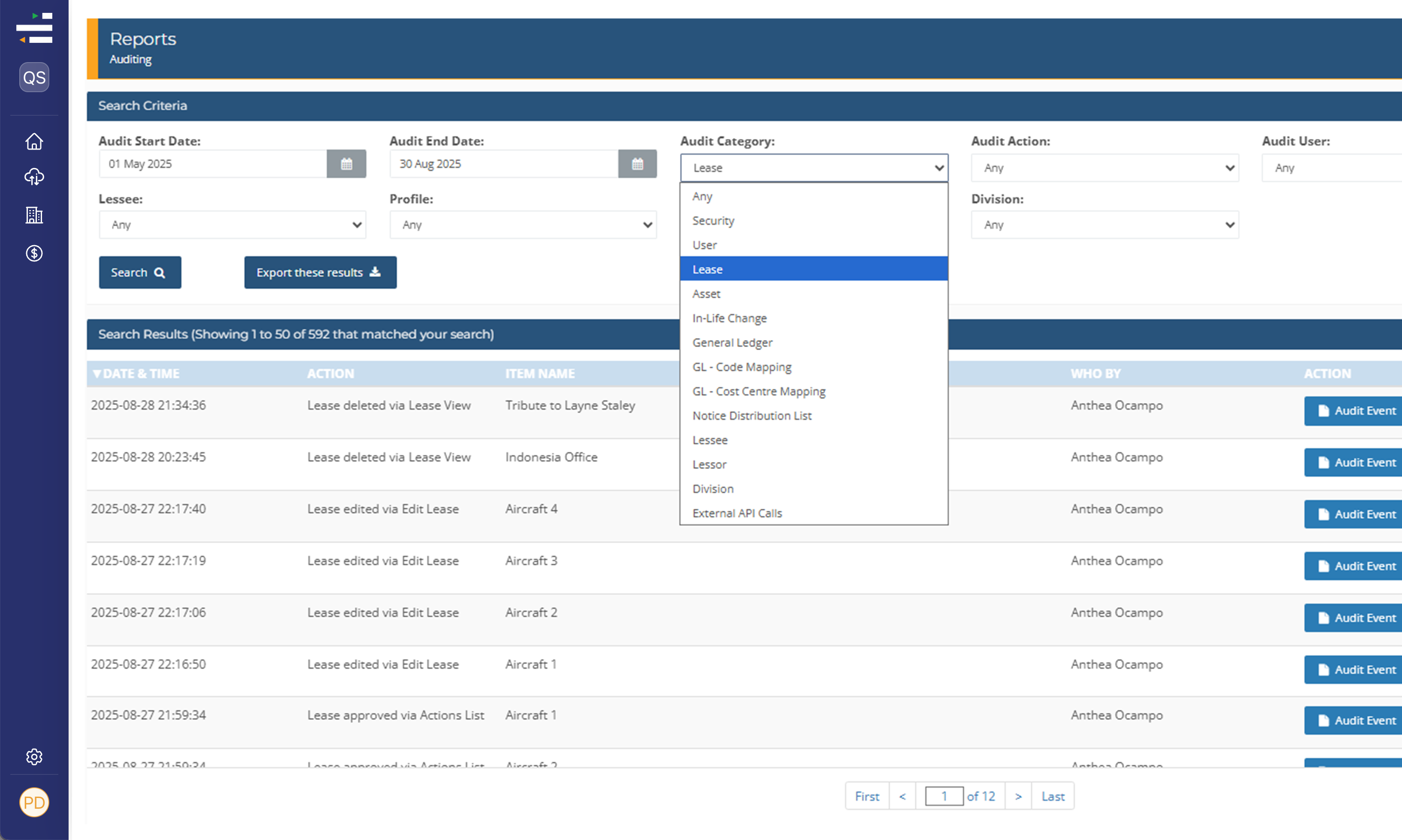

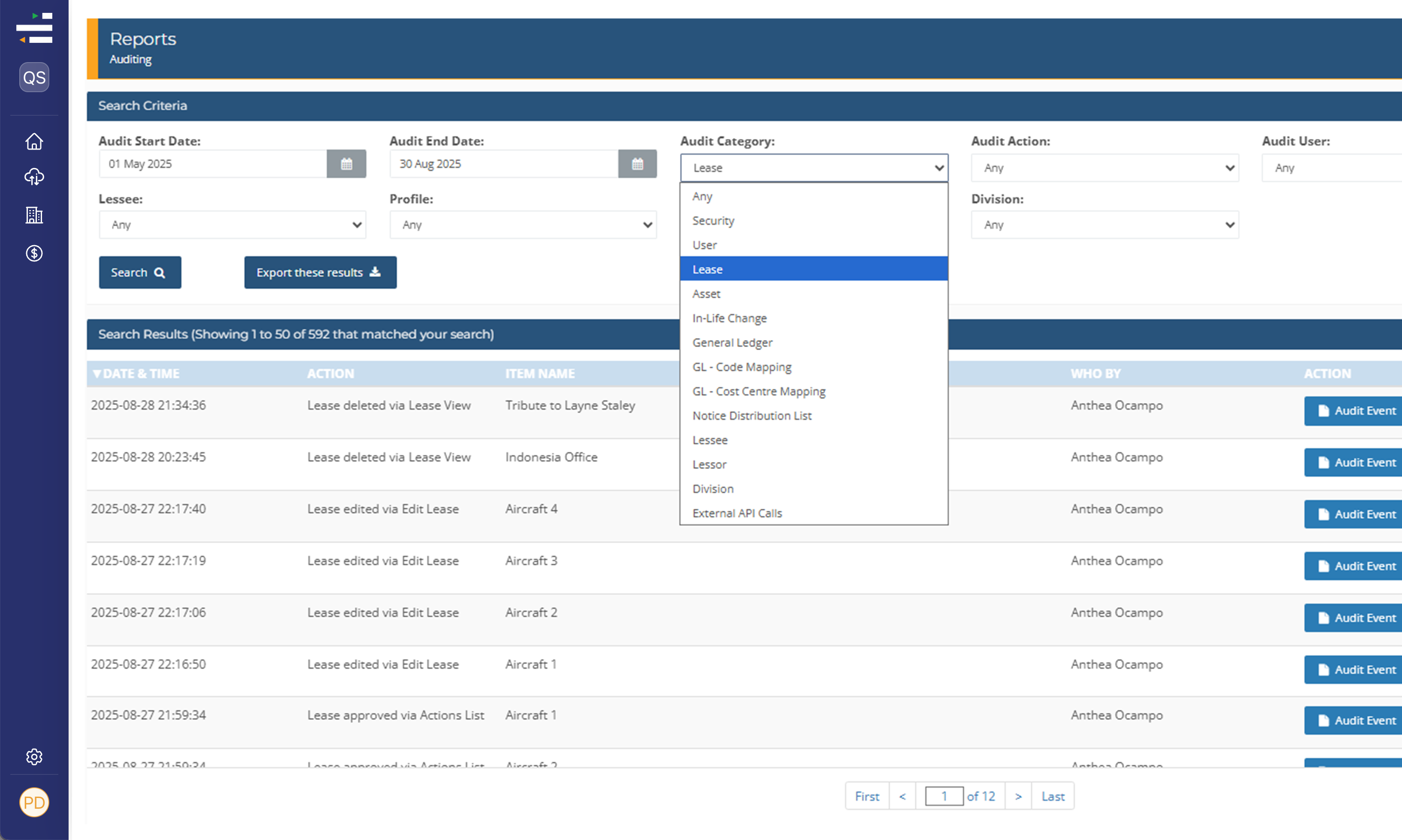

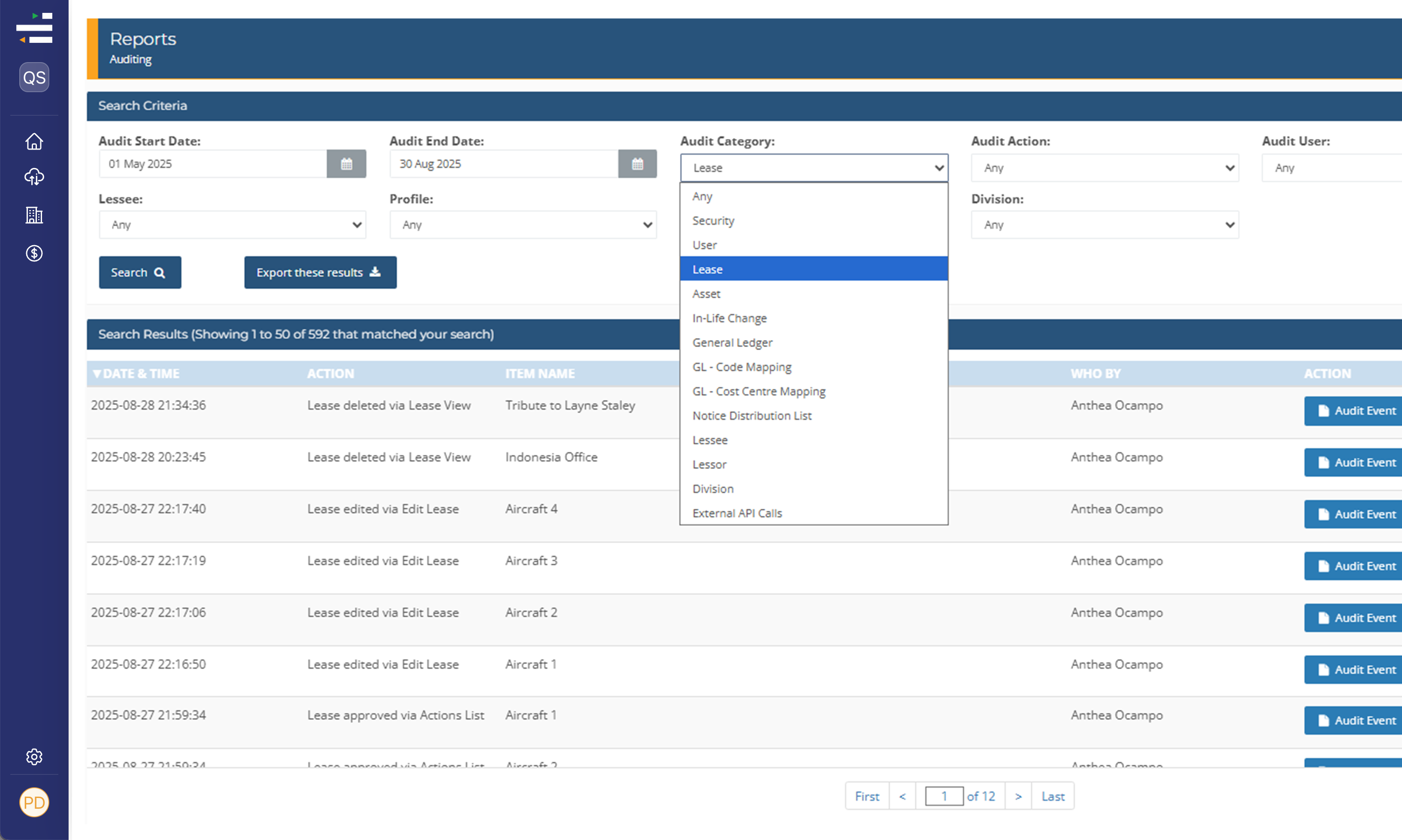

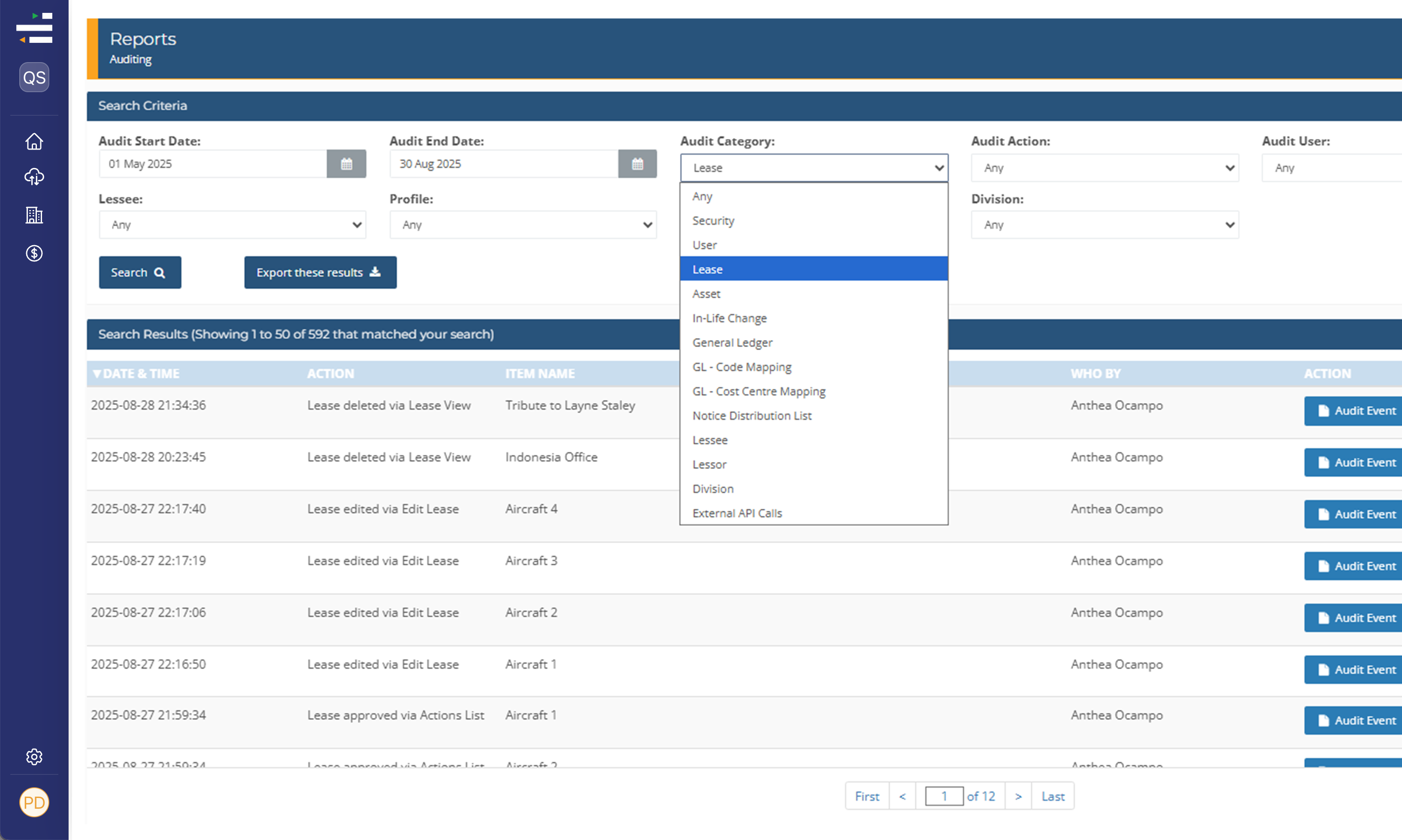

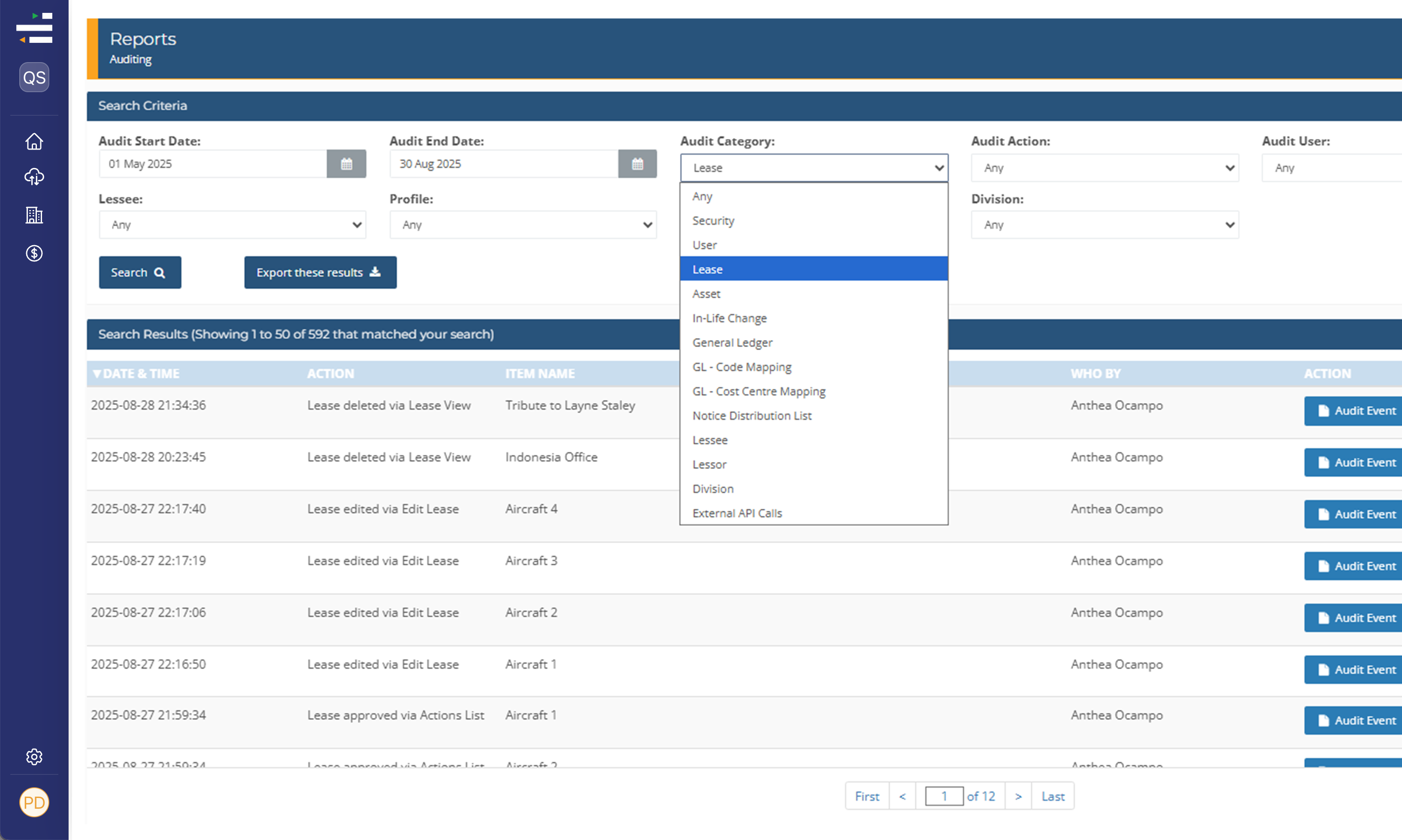

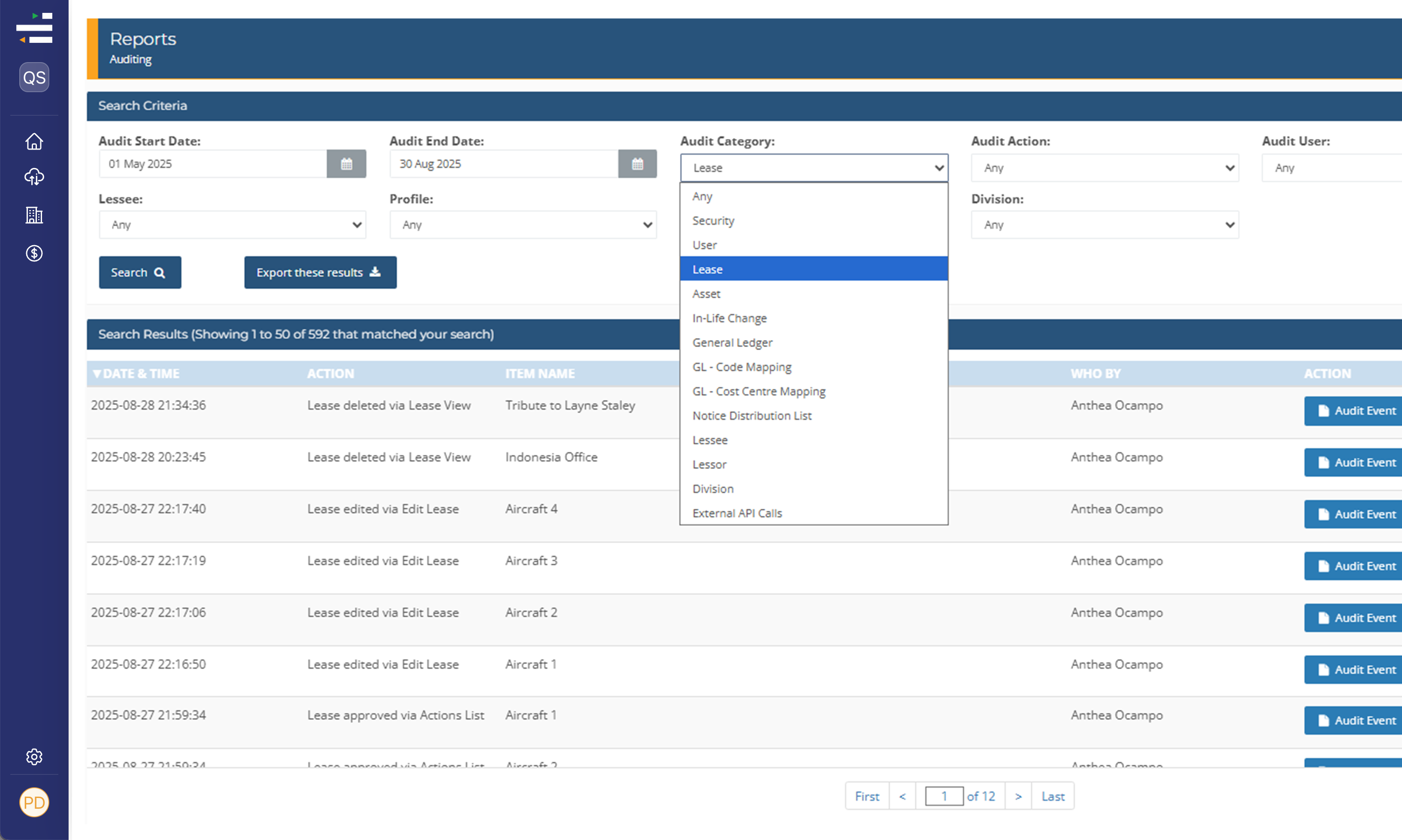

Collaboration & control

LOIS is designed for everyone in your organisation who is involved with leasing. Create multiple user accounts (including for your auditors) with customised access levels so you can work with the real-time data you need.

LOIS can be set up within four weeks, without having to change all your existing systems and processes. This setup includes:

- Dual approval process and workflow with reminders for both user actions and lifecycle actions around end of lease and renewals/options.

- Multi-level hierarchy and security which is fully customised

- Audit tracking of all user access and modifications/amendments

- Cost centre allocations and aggregation

- Unlimited user access

Additional LOIS features (optional add-ons)

These additional features can be added as extra to your standard LOIS subscription, enhancing your ability to proactively manage your lease portfolio and confidently make strategic leasing decisions.

- The Sandpit - A budgeting and forecasting tool designed to let you model and investigate the financial impact of future adjustments to your lease portfolio without impacting your live data.

- Low-value leases - Add your low-value leases to LOIS at a much lower cost per lease rate. Having all your lease information in one central place allows you to review the ROI of your entire lease portfolio. Individually, these may not be material, but when aggregated they could result in large savings if you are being overcharged or duplicating these leases.

- Month-end process consulting - Make significant time savings at these business-critical periods with a more streamlined lease accounting month-end process. Take advantage of our in-house CA-qualified leasing accountants and let us review, analyse, and feedback on your month-end process.

Helpful resources

.webp?width=160&height=209&name=Group%2096415%20(1).webp)

LOIS Lease Accounting software features

All the information you need about LOIS, a lease accounting solution that can help you comply with the accounting standards IFRS 16, AASB 16, FRS 102 and FASB ASC 842.

LOIS Client success

stories

Discover how companies across various industries have leveraged LOIS lease accounting software to streamline their financial processes and achieve remarkable results.

Spreadsheets vs Lease Accounting Software - the best approach

We explore the pros and cons of using lease accounting software vs. spreadsheet applications, such as Excel, for compliance and lease management.